Case study: Major savings in workers’ compensation costs for a national retailer

In the retail industry, serious injuries cost U.S. companies nearly $100 million per week.1 To manage these costs, one national department store chain added Kaiser Permanente’s occupational health program to their provider networks — and experienced dramatic reductions in workers’ compensation costs.

Challenge: Workplace injuries and high compensation premiums

Physical activity like lifting and moving boxes is often part of the job for employees working in retail. Unfortunately, these activities are also the leading cause of disabling workplace injuries.2 So for a large luxury department store chain with 71,000 employees, workers’ compensation costs are a significant concern. Also, much of the company’s workforce is based in California, where workers’ compensation premiums are 69% higher than the national average.3

Solution: Lower costs per claim with Kaiser Permanente On-the-Job®

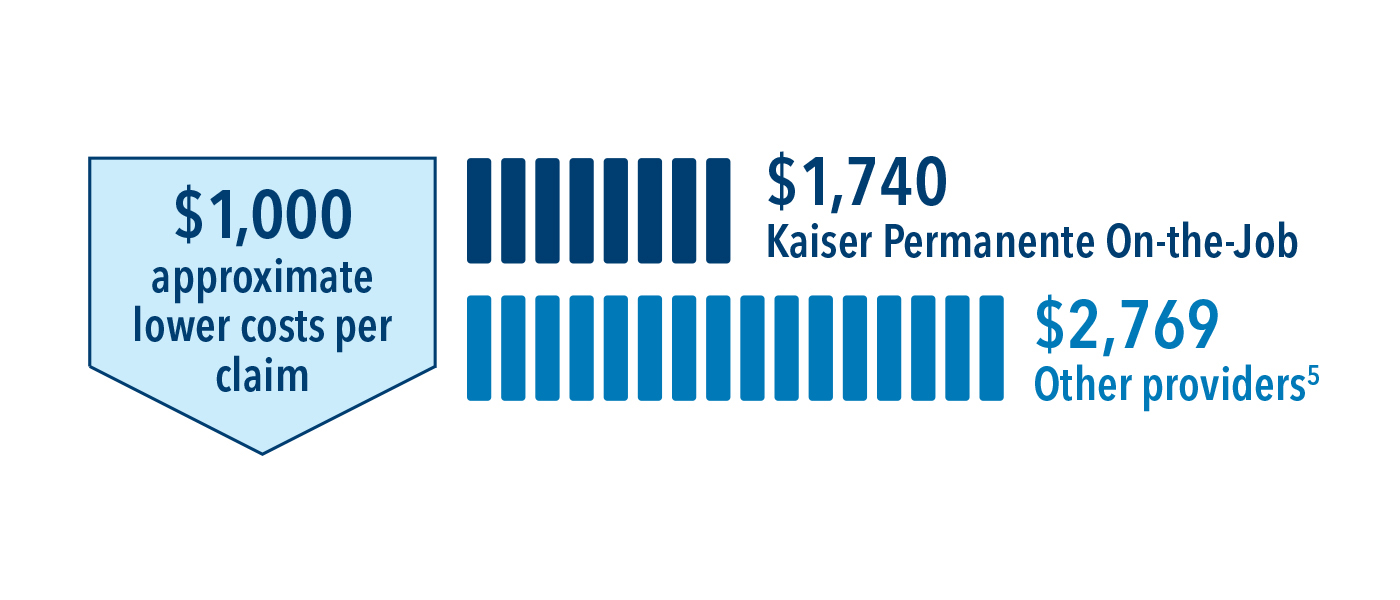

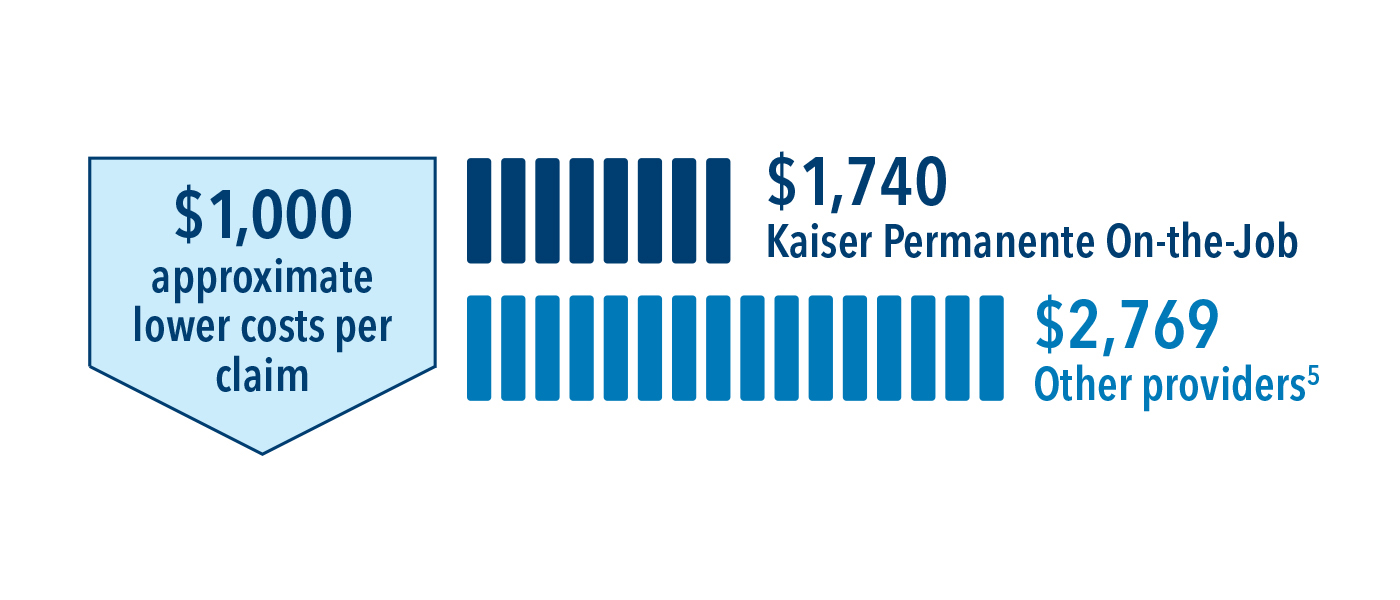

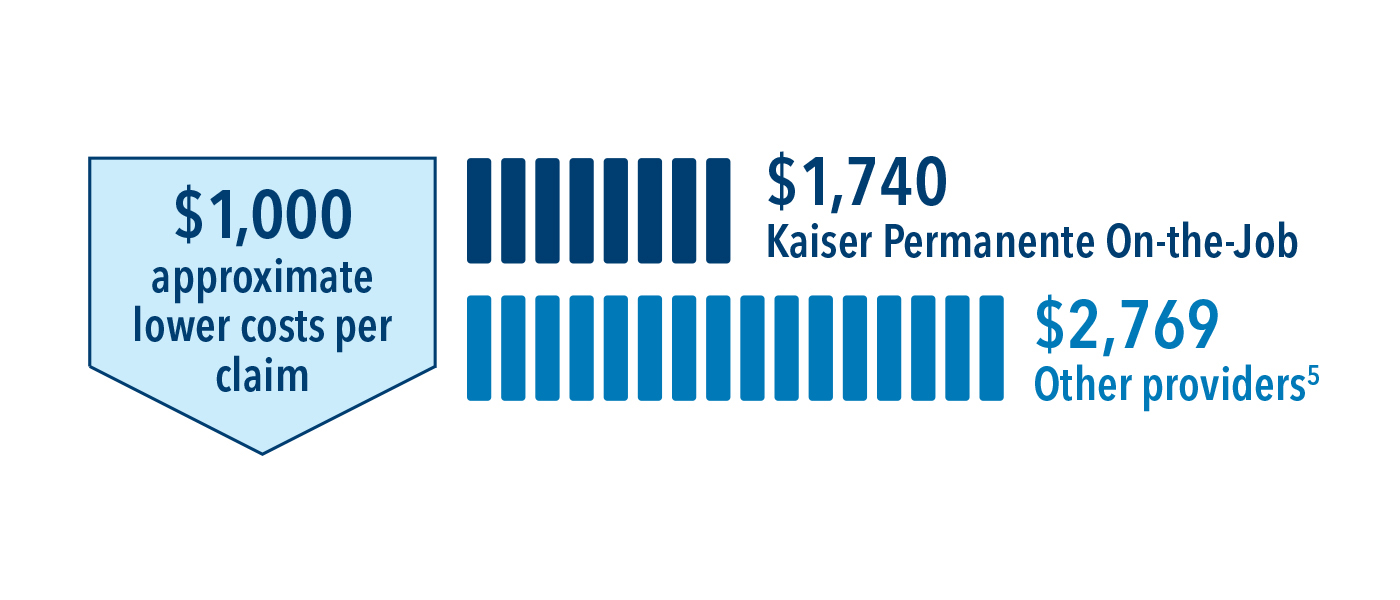

According to workers’ compensation analytics company MedMetrics, our occupational health program, Kaiser Permanente On-the-Job, reduced the department store’s costs per claim by 37% — $1,740 with care from Kaiser Permanente On-the-Job versus $2,769 with other providers, or approximately $1,000 lower costs per claim.5 They reviewed 1,526 claims from a 3-year period and found that employees treated at Kaiser Permanente On-the-Job facilities also had 18% lower medical costs and 73% fewer claims involving litigation compared with employees treated elsewhere.4

Significant savings with Kaiser Permanente On-the-Job — Average cost per claim:5

Connected care for a better bottom line

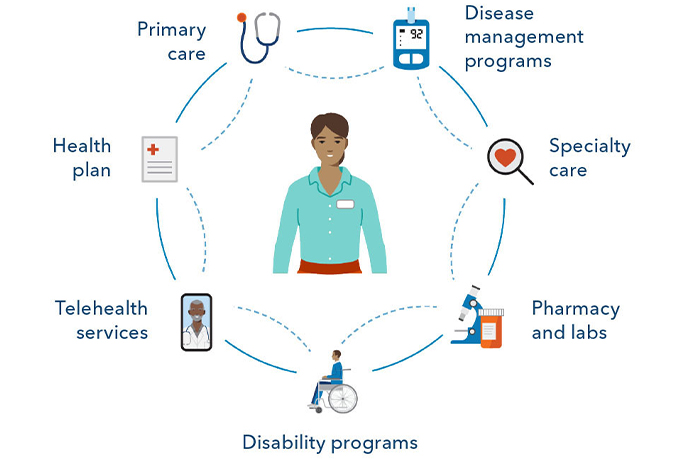

Kaiser Permanente On-the-Job follows state-mandated fee schedules, relying on an outcomes-based strategy to manage claims costs. Elements of this approach include:

Integrated care — Our occupational health physicians, nurses, care coordinators, and therapists are connected to the same electronic health record system. Real-time access to medical records means they can make well-informed decisions faster for better outcomes and higher patient satisfaction.

Convenient locations — Many Kaiser Permanente On-the-Job facilities are located at or near our medical offices and hospitals. This means employees — even those who aren’t Kaiser Permanente members — can get the care they need quickly, so they can return to health and to work as soon as appropriate.

Coordinated case management — Kaiser Permanente On-the-Job keeps employers informed with regular work status reports and works with them to help ensure employees return to work appropriately.

Protect your business with our occupational health care

With integrated occupational health services from Kaiser Permanente, your employees will get high-quality care, leading to safer, faster recoveries. We’re here to support you — so you can take care of your employees while also protecting your business from rising workers’ compensation costs.

Find the right plan for your business 877-305-7933

Footnotes:

1Workplace Safety Index: Retail Trade, Liberty Mutual Insurance, 2019.

22021 Workplace Safety Index: The Top 10 Causes of Disabling Injuries at Work, Liberty Mutual Insurance, July 15, 2021.

32020 Workers’ Compensation Premium Index Rates, Oregon Department of Consumer and Business Services, 2020.

4MedMetrics, 2018. Results for claimants treated only at Kaiser Permanente On-the-Job compared with claimants treated elsewhere.

5See note 4.